Choosing Between a Local Bank and a National Chain: Key Considerations

21 May 2025

When it comes to choosing where to stash your hard-earned cash or get a loan, the decision usually boils down to two options: a local bank or a national chain. At first glance, it might not seem like a big deal—after all, a bank is just a place to keep your money, right? Spoiler alert: It’s so much more than that. The financial institution you choose can impact everything from the fees you pay to the relationships you build, and even the ease with which you do your banking. So, how do you decide? Strap in, because we're about to break down the key considerations to help you make the smartest choice for your financial future.

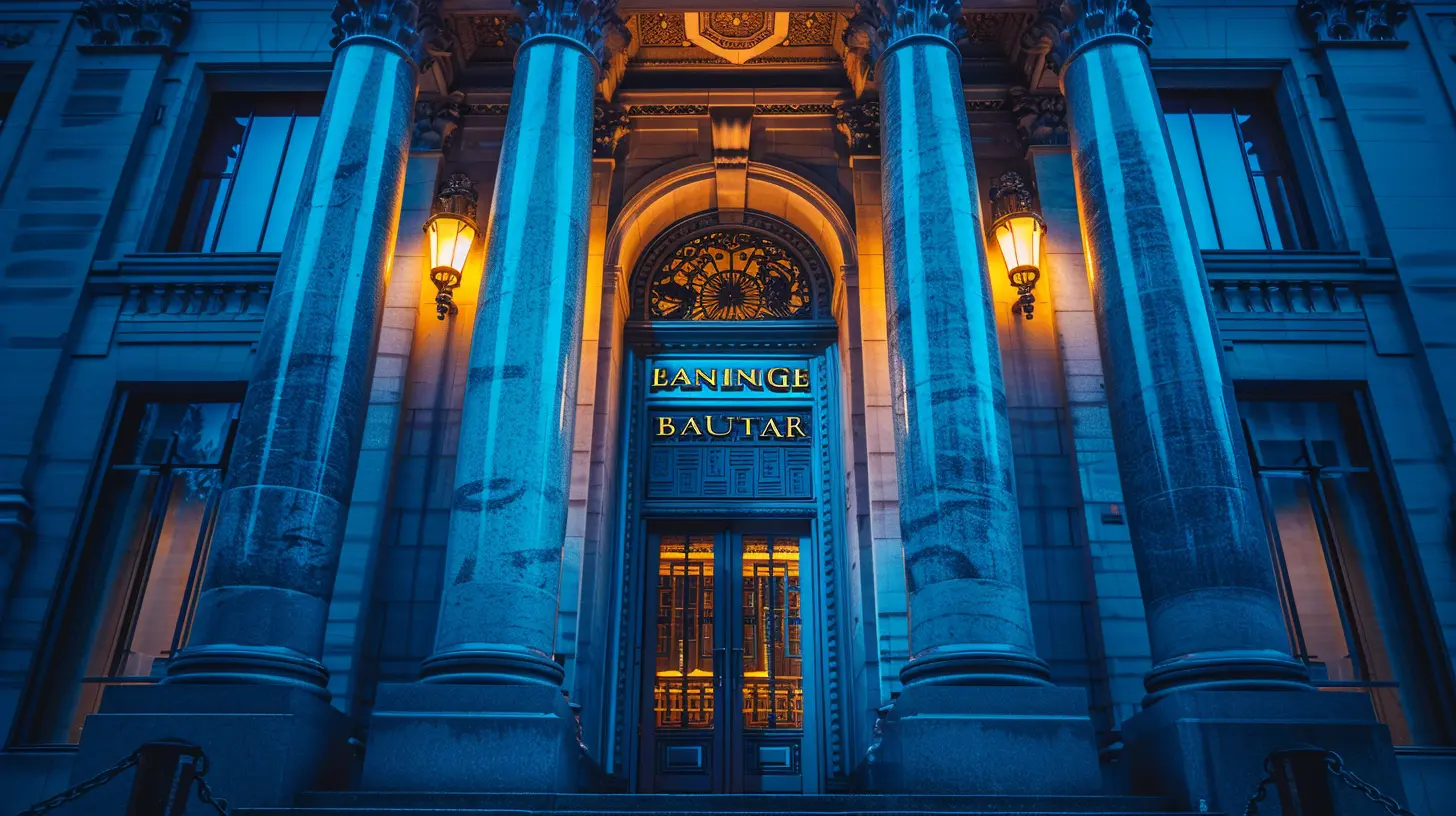

Understanding the Basics: What’s the Difference?

Let’s clear the air right at the start. A local bank is often smaller, community-oriented, and typically serves a limited geographical area. Think of it as the “mom-and-pop shop” of the banking world. They’re all about personal service and local connections.A national bank, on the other hand, is exactly what it sounds like: a big player on the national (or even global) stage. These institutions have branches dotted across the country and offer a range of products and services with conveniences like ATMs and mobile apps.

Both have their perks and quirks, so how do you know which one’s the right fit? Let’s dig deeper.

1. Customer Service: The Personal Touch vs. The Corporate Machine

Picture this: You walk into your local bank, and the teller greets you by name. They ask about your kids, your dog, and that bakery you just opened downtown. Sounds nice, right? That’s the kind of personal connection local banks are known for. Because they serve a smaller community, local banks often go out of their way to treat you like a valued customer, not just another account number.In contrast, national chains often deal with a massive volume of customers. Sure, they might have 24/7 customer service hotlines and chatbots, but let’s be real—how many times have you called a customer support line and felt like you were talking to a robot? (Even when it wasn’t a robot.)

If strong, genuine relationships matter to you, a local bank might win this round. If you value convenience over chitchat, the big names may have your back.

2. Convenience: Access Anytime, Anywhere

Can we talk about convenience for a sec? Big national banks thrive on making your life easy. Need to withdraw cash at 2 a.m. in a city you’ve never been to? That ATM with a familiar logo has your back. Want to deposit a check from your phone while binge-watching your favorite series? Their mobile apps are state-of-the-art.Local banks, while charming and personable, can’t always compete on this front. They might have fewer ATMs, shorter hours, or less sophisticated online tools. If you travel frequently or need constant access to banking features, it’s hard to beat what the national chains offer. On the flip side, if you stick close to home and value face-to-face interactions, a local bank can be just as convenient—for you.

3. Rates and Fees: The Devil is in the Details

Let’s cut to the chase: nobody likes fees. Monthly maintenance fees, ATM fees, overdraft fees—you name it. This is where local banks often shine. They tend to offer lower fees and better interest rates on loans and savings accounts. It’s all part of being community-focused. They’re not trying to nickel-and-dime you; they want to keep you happy.National banks, meanwhile, have a reputation for charging higher fees. Why? Because their overhead costs are massive—think thousands of branches, advertising campaigns, and those slick apps. The tradeoff is the convenience and range of services they provide.

Want to save on fees? Pull out a calculator and compare the fine print. Sometimes, those “free checking” accounts at national banks come with strings attached, like minimum account balances or direct deposit requirements.

4. Loan Approvals: Local Love vs. Corporate Red Tape

Thinking of starting a business or buying a home? The loan approval process can vary significantly depending on your chosen institution. Local banks are more flexible when it comes to lending. Since they know the local economy and their customers personally, they might be more willing to take a chance on you, even if your credit score isn’t perfect. It's like borrowing money from a friendly neighbor who trusts that you'll pay it back.National banks, on the other hand, have stricter lending criteria. They rely on algorithms and often need a near-perfect credit score before they’ll even consider your application. While this ensures consistency, it can also mean missing out on opportunities if you don’t fit their mold.

So, if you’re looking for a lender who sees the bigger picture (and not just numbers on a screen), a local bank might have your back.

5. Community Impact: Supporting Local vs. Global Reach

Let’s talk about the feel-good factor. Local banks are deeply invested in their communities. They sponsor local events, provide funding for small businesses, and reinvest in the area they serve. Choosing a local bank often feels like giving back to your hometown—you’re supporting neighbors, not stockholders.National banks, however, operate on a completely different scale. While they may fund global initiatives or offer impressive philanthropic programs, their connection to any single community is often diluted. If contributing to your local economy matters to you, going local is a no-brainer.

6. Products and Services: Breadth vs. Customization

National banks have an edge when it comes to offering a wide range of products and services. From investment accounts to international wire transfers, they have all the bells and whistles. Want to open a savings account for your kid, apply for a mortgage, and set up a retirement fund all in one afternoon? They’re equipped for that.Local banks, while less diverse in their offerings, make up for this by tailoring their services to the specific needs of their community. For example, they might have unique loan programs for local farmers or small business owners. It’s a tradeoff—do you value variety or customization more?

7. Stability and Security: A Trust Issue

In terms of financial stability, national banks often have the upper hand simply because they’re, well, massive. They have billions in assets and are less likely to falter during economic downturns. Plus, they come with the added benefit of advanced security measures to protect your accounts from fraud.Local banks are, of course, FDIC insured (as are national ones), so your deposits are safe up to $250,000. However, they may lack some of the high-tech bells and whistles of national chains.

If you’re the type to lose sleep over the security of your savings, this is worth considering. That said, many local banks are catching up in this area, offering competitive digital security tools.

Making the Decision: What Matters Most to YOU?

At the end of the day, the choice between a local bank and a national chain boils down to your personal priorities. Ask yourself:- Do I value personal relationships and community impact over convenience and technology?

- Am I more concerned about fees or the breadth of services?

- Do I need a bank with a global reach, or am I perfectly fine banking within my local area?

Choosing a bank is like dating: No one-size-fits-all approach works here. Don’t be afraid to explore your options, ask questions, and even test the waters with both types of institutions before making a commitment. After all, when it comes to your money, you deserve the best fit.

Conclusion: Balance is Key

Choosing between a local bank and a national chain doesn’t have to be an all-or-nothing decision. Many people opt to do business with both—using a national chain for its convenience and a local bank for its personal touch and community ties. Play your cards right, and you can enjoy the best of both worlds.Now that you’ve got the info, the ball’s in your court. Which type of bank will you choose?

all images in this post were generated using AI tools

Category:

Banking TipsAuthor:

Julia Phillips

Discussion

rate this article

4 comments

Uma Kim

When choosing between a local bank and a national chain, consider not only financial services but also community impact, personalized relationships, and long-term trust in your financial journey.

June 9, 2025 at 4:50 AM

Julia Phillips

Thank you for highlighting such important factors! Community impact and personalized relationships can significantly enrich our financial experiences.

Winter Mason

Great insights! It’s crucial to weigh personalized service against broader services when selecting a bank that meets your financial needs.

June 1, 2025 at 4:43 AM

Julia Phillips

Thank you! Balancing personalized service and broader offerings is indeed vital for making the right banking choice.

Adeline McCune

Great insights! It's crucial to weigh personal service against wider options. Local banks often provide tailored support, while national chains may offer more services and technology. Understanding your priorities can help make the right choice for your financial needs.

May 28, 2025 at 3:42 AM

Julia Phillips

Thank you for your thoughtful comment! You're absolutely right—balancing personal service with available options is essential in making an informed decision.

Cooper McVicker

Why choose a faceless national chain when your local bank knows your name and your community? Sure, they might not have the snazzy app, but at least you won't be just another account number in their oversized machine. Choose wisely!

May 21, 2025 at 5:01 AM

Julia Phillips

Thank you for your comment! Choosing a local bank often means personalized service and community support, while national chains may offer more advanced technology. Ultimately, it’s about finding the right balance that meets your needs.