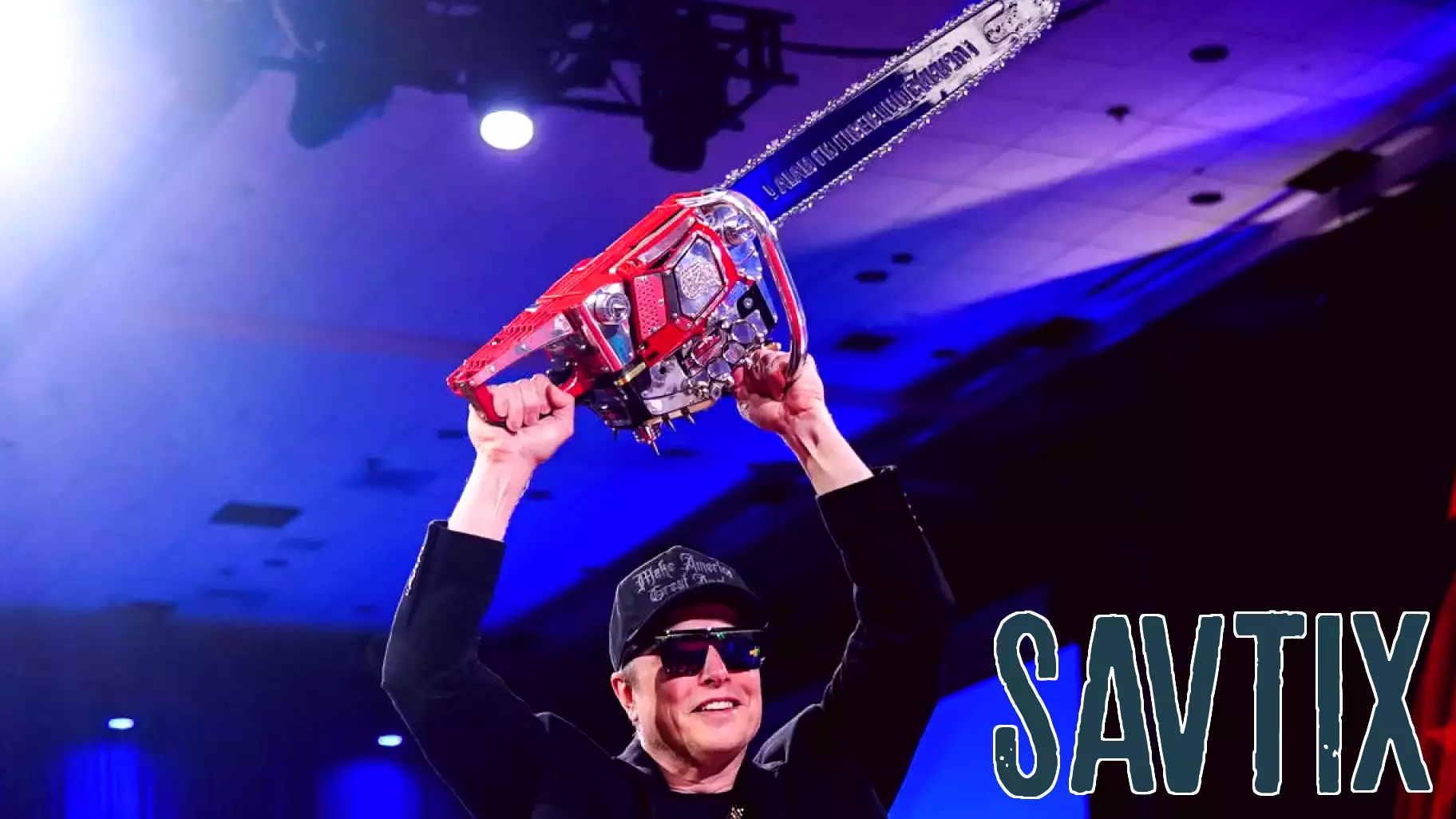

Consultants Bear the Brunt of DOGE Cost-Cutting Measures

February 23, 2025 - 05:53

The recent cost-cutting measures implemented by Elon Musk's DOGE have sent shockwaves through the consulting industry, resulting in hundreds of millions of dollars in canceled or renegotiated contracts. As businesses tighten their belts in response to fluctuating market conditions, consultants across various sectors are feeling the impact.

Many firms that relied heavily on lucrative contracts are now scrambling to adjust their business models. The shifts have forced some consultants to lay off staff or pivot their services to remain competitive. The reduction in spending has not only affected large consulting firms but has also trickled down to smaller boutique agencies that are struggling to survive in this new economic landscape.

Industry experts suggest that the long-term effects of these cuts could reshape the consulting landscape, leading to a more cautious approach to contract negotiations and project scopes. As companies reassess their priorities, the future remains uncertain for many in this once-thriving sector.

MORE NEWS

February 24, 2026 - 19:13

ADOCIA Reports Fourth Quarter 2025 Financial Results and Provides a Business UpdateLYON, France, February 24, 2026 -- Adocia, a clinical-stage biopharmaceutical company, has announced its financial results for the fourth quarter ending December 31, 2025, alongside a comprehensive...

February 24, 2026 - 05:08

Finance expert Anthony O'Neal on unlocking freedomOn a recent episode of a popular live news and lifestyle program, renowned finance expert Anthony O`Neal shared his powerful message on achieving true financial and personal liberation. His...

February 23, 2026 - 03:13

The world's largest energy lender has a new head: Here's how it could shape U.S. policyGregory Beard now leads the Office of Energy Dominance Financing, an entity commanding nearly $300 billion in lending capacity. His appointment places a seasoned financier with deep energy sector...

February 22, 2026 - 06:32

I’m 80 with $1 million. How do I prevent my son from being hit with taxes?Navigating estate taxes is a common concern for seniors aiming to preserve their legacy for their heirs. For an individual with a $1 million portfolio, comprised of $650,000 in investments,...