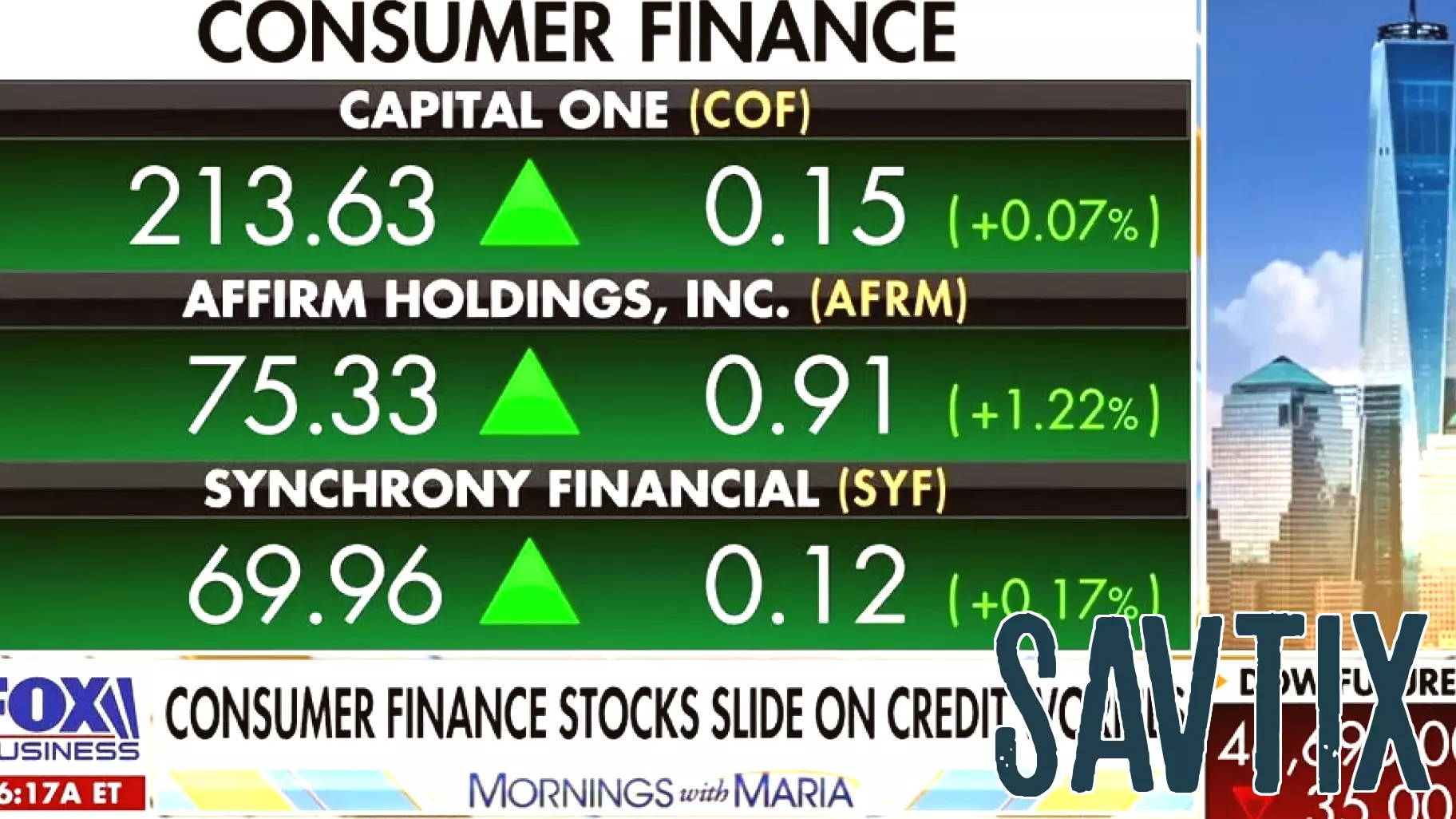

Consumer Finance Stocks Decline Amid Rising Credit Concerns

October 2, 2025 - 22:14

A recent discussion on a financial panel has highlighted growing worries regarding consumer debt levels and their impact on the market. Experts emphasized that the increasing trend of consumers taking on significant amounts of debt poses a "real concern" for the economy. This anxiety has led to a noticeable decline in consumer finance stocks, reflecting investor apprehension about the sustainability of consumer spending.

As households grapple with rising interest rates and inflationary pressures, many consumers are resorting to credit to maintain their lifestyles. This reliance on borrowing raises questions about the long-term viability of consumer finance companies. Analysts are closely monitoring these trends, as excessive debt could lead to increased defaults and a subsequent ripple effect throughout the financial sector.

The panelists urged caution, suggesting that both consumers and investors should be aware of the potential risks associated with high levels of debt. The current economic landscape necessitates a careful evaluation of financial habits and investment strategies moving forward.

MORE NEWS

February 24, 2026 - 19:13

ADOCIA Reports Fourth Quarter 2025 Financial Results and Provides a Business UpdateLYON, France, February 24, 2026 -- Adocia, a clinical-stage biopharmaceutical company, has announced its financial results for the fourth quarter ending December 31, 2025, alongside a comprehensive...

February 24, 2026 - 05:08

Finance expert Anthony O'Neal on unlocking freedomOn a recent episode of a popular live news and lifestyle program, renowned finance expert Anthony O`Neal shared his powerful message on achieving true financial and personal liberation. His...

February 23, 2026 - 03:13

The world's largest energy lender has a new head: Here's how it could shape U.S. policyGregory Beard now leads the Office of Energy Dominance Financing, an entity commanding nearly $300 billion in lending capacity. His appointment places a seasoned financier with deep energy sector...

February 22, 2026 - 06:32

I’m 80 with $1 million. How do I prevent my son from being hit with taxes?Navigating estate taxes is a common concern for seniors aiming to preserve their legacy for their heirs. For an individual with a $1 million portfolio, comprised of $650,000 in investments,...