How to Safeguard Your Wealth in a Changing Economic Landscape

September 14, 2025 - 05:44

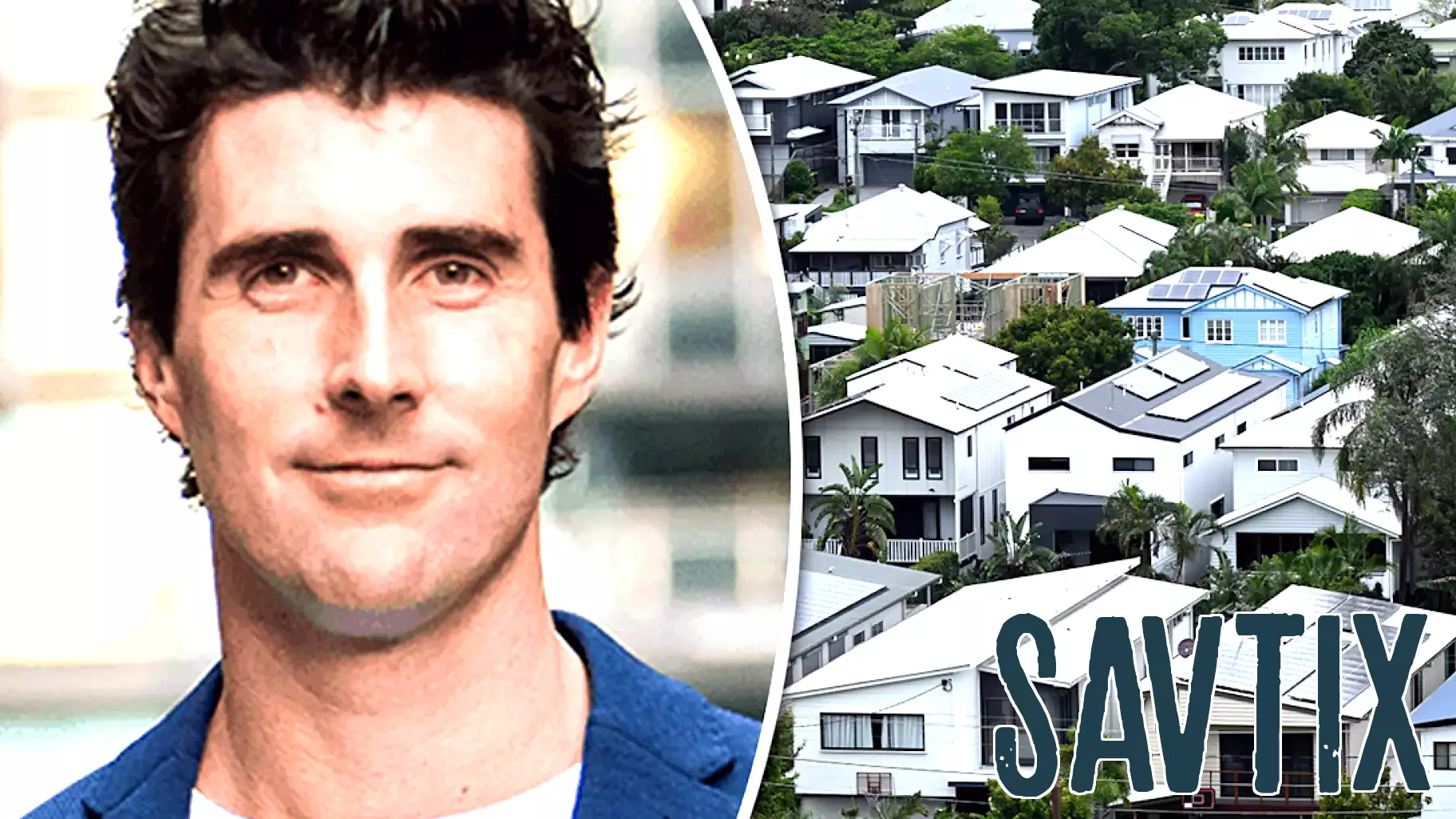

Scott O'Neill and his wife Mina have successfully built a formidable real estate portfolio consisting of 28 properties, yielding an impressive annual profit of $300,000 and approximately $7 million in equity. As interest rates begin to decline, O'Neill emphasizes the importance of strategic investment to "recession-proof" one's financial standing.

In a time where economic uncertainty looms, O'Neill advocates for diversification in property investment, suggesting that a well-rounded portfolio can provide stability and security. He highlights the significance of thorough market research and understanding local trends to make informed decisions.

Moreover, O'Neill encourages aspiring investors to focus on cash flow properties that can sustain income during downturns. By prioritizing long-term growth and maintaining a keen awareness of the economic climate, individuals can better navigate financial challenges. O'Neill's insights serve as a valuable guide for those looking to fortify their financial future amidst fluctuating interest rates.

MORE NEWS

February 24, 2026 - 19:13

ADOCIA Reports Fourth Quarter 2025 Financial Results and Provides a Business UpdateLYON, France, February 24, 2026 -- Adocia, a clinical-stage biopharmaceutical company, has announced its financial results for the fourth quarter ending December 31, 2025, alongside a comprehensive...

February 24, 2026 - 05:08

Finance expert Anthony O'Neal on unlocking freedomOn a recent episode of a popular live news and lifestyle program, renowned finance expert Anthony O`Neal shared his powerful message on achieving true financial and personal liberation. His...

February 23, 2026 - 03:13

The world's largest energy lender has a new head: Here's how it could shape U.S. policyGregory Beard now leads the Office of Energy Dominance Financing, an entity commanding nearly $300 billion in lending capacity. His appointment places a seasoned financier with deep energy sector...

February 22, 2026 - 06:32

I’m 80 with $1 million. How do I prevent my son from being hit with taxes?Navigating estate taxes is a common concern for seniors aiming to preserve their legacy for their heirs. For an individual with a $1 million portfolio, comprised of $650,000 in investments,...