Over 1,600 Financial Institutions Utilize Fed's Emergency Lending Program

March 13, 2025 - 09:41

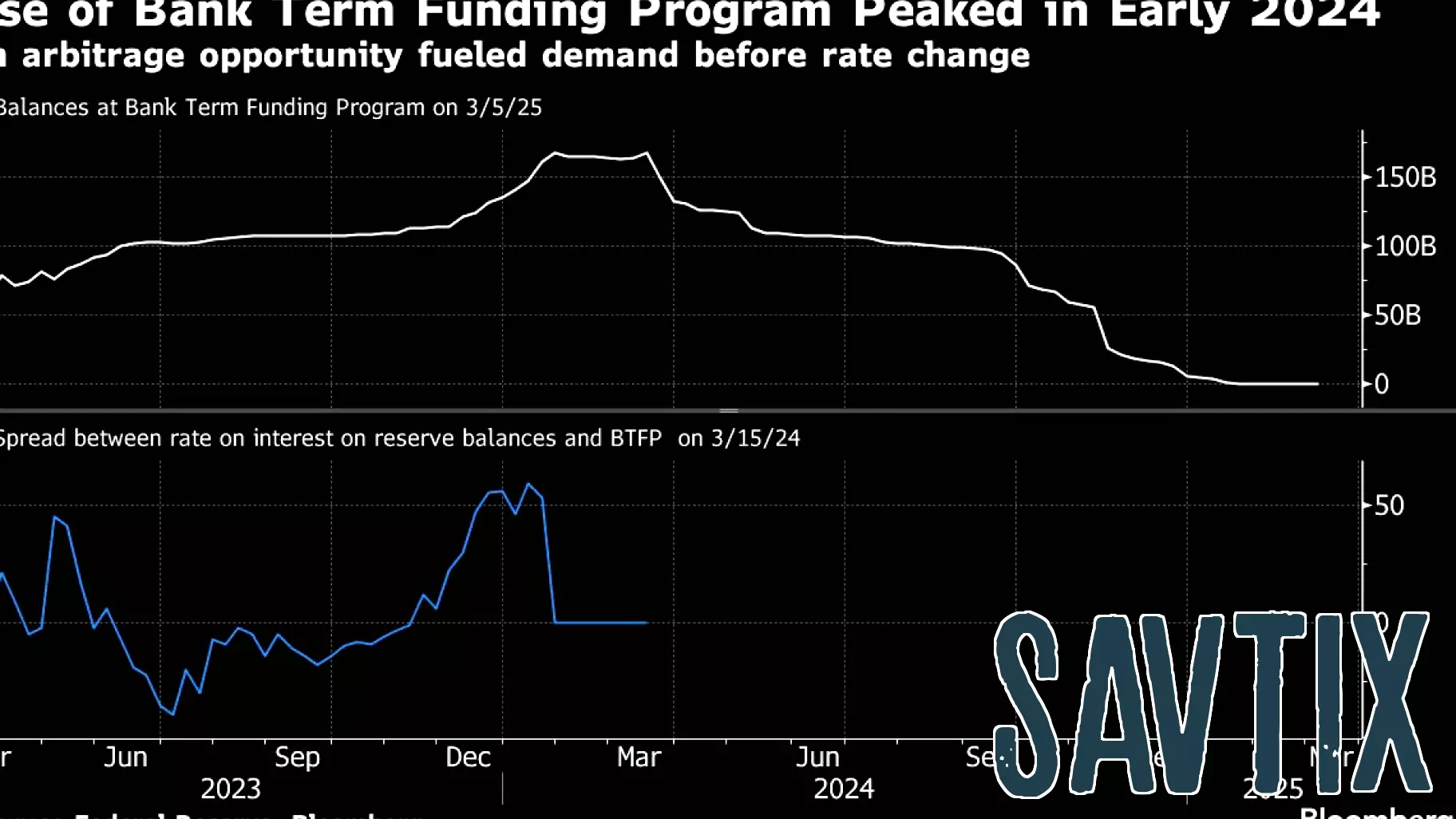

In a significant response to the regional banking crisis that unfolded two years ago, over 1,600 banks and their subsidiaries have accessed the Federal Reserve's emergency lending program. This initiative was designed to provide crucial support to the financial sector during a period marked by instability and uncertainty.

The program was established to ensure liquidity and bolster confidence among financial institutions grappling with the fallout from the banking turmoil. By offering a safety net, the Federal Reserve aimed to stabilize the banking system and prevent further disruptions in the economy.

The widespread participation in this emergency lending program underscores the challenges faced by many banks during this turbulent period. As financial institutions continue to navigate the complexities of the market, the Fed's support remains a vital resource in maintaining stability and fostering recovery within the banking sector. The ongoing reliance on such measures reflects the cautious approach many banks are taking as they work to rebuild and strengthen their operations in the wake of past crises.

MORE NEWS

February 24, 2026 - 19:13

ADOCIA Reports Fourth Quarter 2025 Financial Results and Provides a Business UpdateLYON, France, February 24, 2026 -- Adocia, a clinical-stage biopharmaceutical company, has announced its financial results for the fourth quarter ending December 31, 2025, alongside a comprehensive...

February 24, 2026 - 05:08

Finance expert Anthony O'Neal on unlocking freedomOn a recent episode of a popular live news and lifestyle program, renowned finance expert Anthony O`Neal shared his powerful message on achieving true financial and personal liberation. His...

February 23, 2026 - 03:13

The world's largest energy lender has a new head: Here's how it could shape U.S. policyGregory Beard now leads the Office of Energy Dominance Financing, an entity commanding nearly $300 billion in lending capacity. His appointment places a seasoned financier with deep energy sector...

February 22, 2026 - 06:32

I’m 80 with $1 million. How do I prevent my son from being hit with taxes?Navigating estate taxes is a common concern for seniors aiming to preserve their legacy for their heirs. For an individual with a $1 million portfolio, comprised of $650,000 in investments,...