Private Credit Market Shows Signs of Vulnerability

April 28, 2025 - 00:17

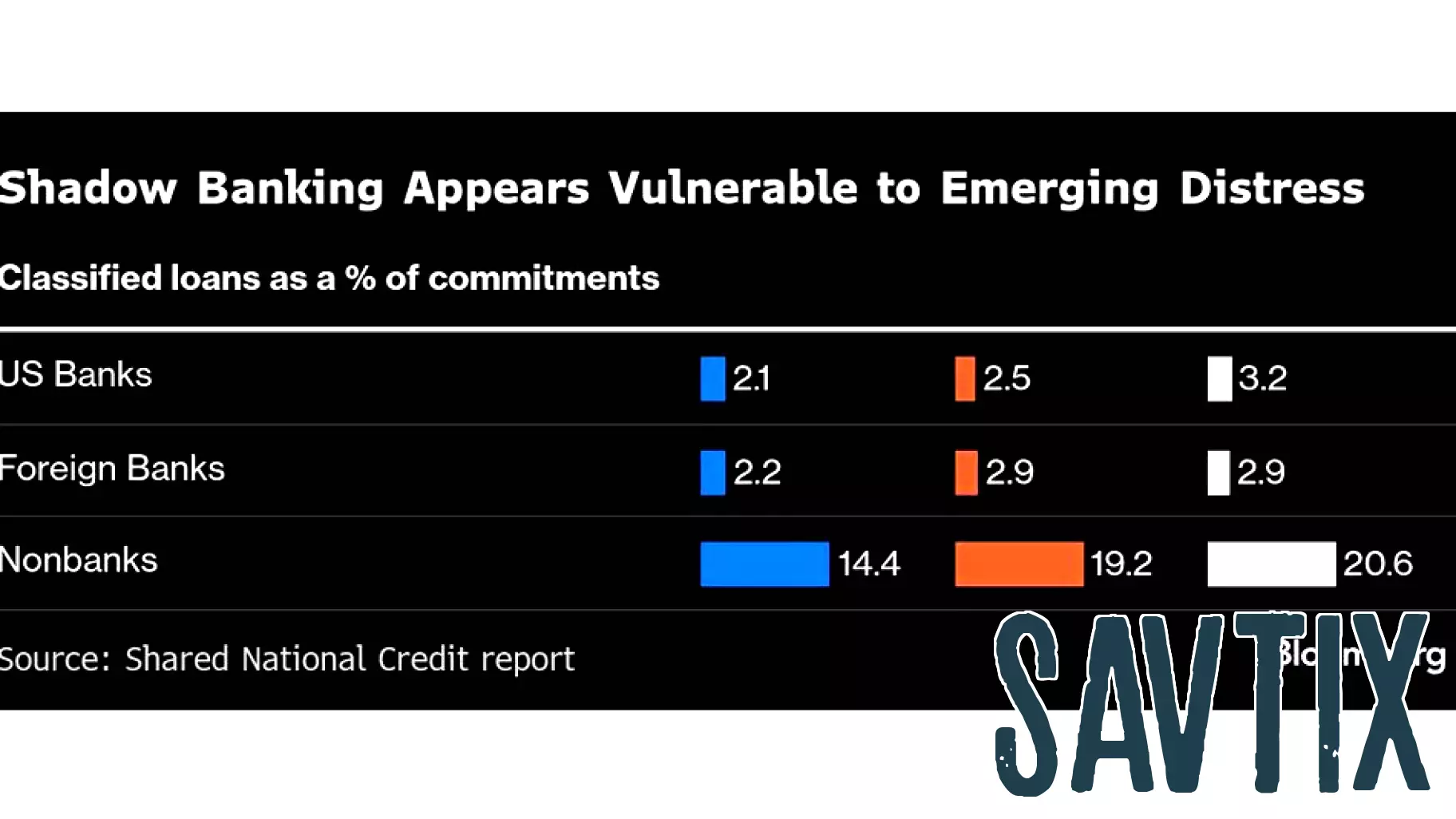

The landscape of private credit is becoming increasingly precarious, as many companies relying on these loans exhibit signs of instability. Recent analyses indicate that borrowers within the private credit sector are facing growing challenges, raising concerns about the potential ripple effects on financial institutions, particularly banks.

As companies struggle to maintain profitability amidst rising interest rates and economic uncertainty, the likelihood of defaults appears to be climbing. This situation poses a significant risk not only to the borrowers but also to the lenders who have extended credit to them. Banks, in particular, could find themselves exposed to substantial losses if these companies fail to meet their repayment obligations.

The implications of this trend extend beyond individual firms, potentially affecting the broader financial ecosystem. Investors and stakeholders are closely monitoring the situation, as the stability of the private credit market is crucial for overall economic health. With the cracks in this segment widening, the need for vigilance and proactive risk management strategies has never been more critical.

MORE NEWS

February 24, 2026 - 19:13

ADOCIA Reports Fourth Quarter 2025 Financial Results and Provides a Business UpdateLYON, France, February 24, 2026 -- Adocia, a clinical-stage biopharmaceutical company, has announced its financial results for the fourth quarter ending December 31, 2025, alongside a comprehensive...

February 24, 2026 - 05:08

Finance expert Anthony O'Neal on unlocking freedomOn a recent episode of a popular live news and lifestyle program, renowned finance expert Anthony O`Neal shared his powerful message on achieving true financial and personal liberation. His...

February 23, 2026 - 03:13

The world's largest energy lender has a new head: Here's how it could shape U.S. policyGregory Beard now leads the Office of Energy Dominance Financing, an entity commanding nearly $300 billion in lending capacity. His appointment places a seasoned financier with deep energy sector...

February 22, 2026 - 06:32

I’m 80 with $1 million. How do I prevent my son from being hit with taxes?Navigating estate taxes is a common concern for seniors aiming to preserve their legacy for their heirs. For an individual with a $1 million portfolio, comprised of $650,000 in investments,...