Short Sellers Retreat as S&P 500 Soars to New Heights

December 3, 2024 - 11:46

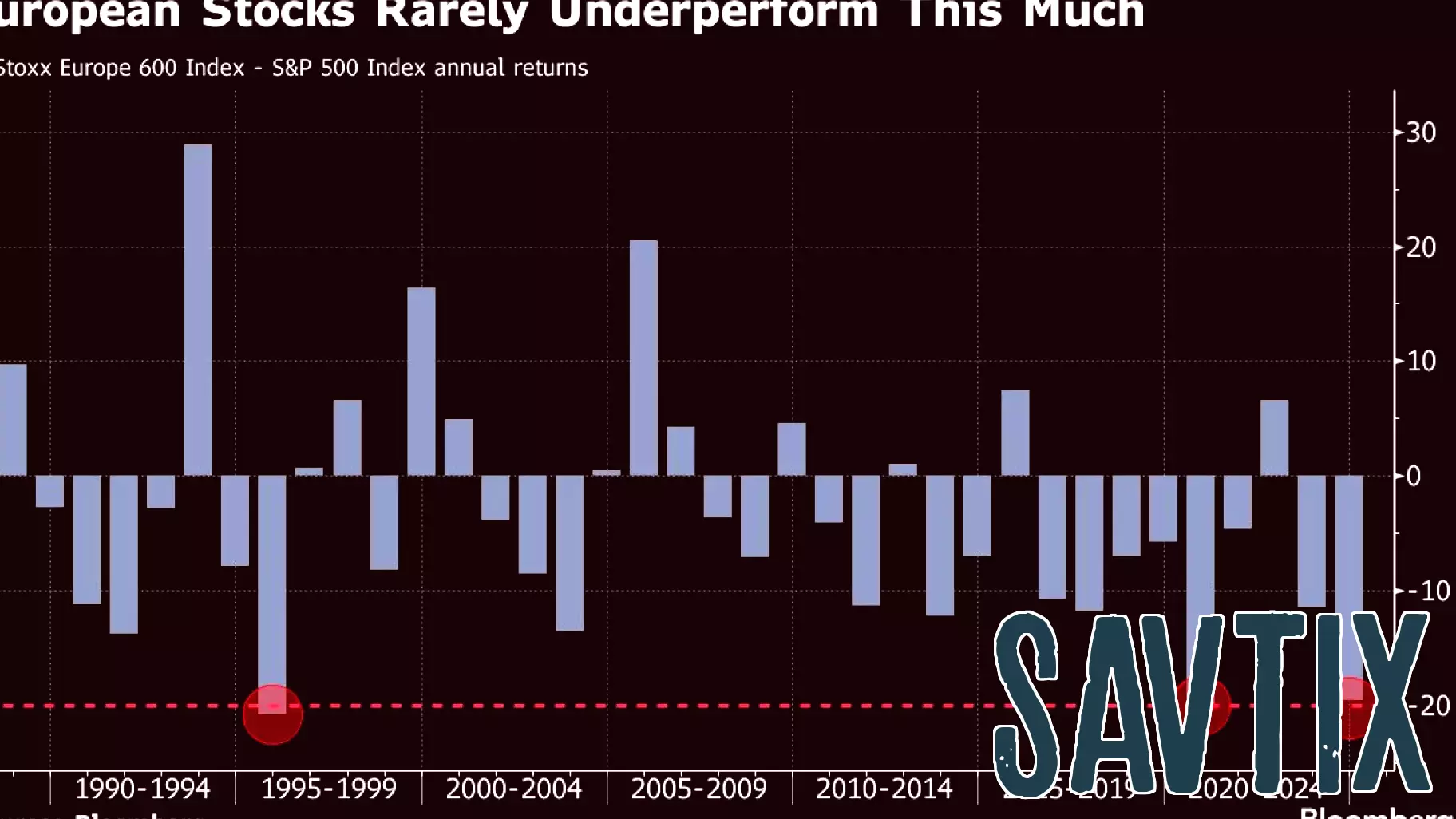

Short sellers are beginning to surrender as the S&P 500 Index continues to reach new record highs, positioning itself for its strongest annual performance since 2021. This trend marks a significant shift in market dynamics, especially as investor sentiment remains overwhelmingly positive toward the U.S. stock market. In contrast, European stocks are experiencing a more pessimistic outlook, with bearish positioning persisting among investors, which further accentuates the disparity between the two markets.

Strategists from Citigroup have noted that the current investor positioning in S&P 500 futures is heavily skewed, indicating a lack of confidence among short sellers. This capitulation reflects a broader trend where market participants are increasingly optimistic about the prospects of U.S. equities, while European markets struggle to gain traction. As the gap between the performance of U.S. and European stocks widens, it raises questions about future investment strategies and the potential for a market correction.

MORE NEWS

February 24, 2026 - 19:13

ADOCIA Reports Fourth Quarter 2025 Financial Results and Provides a Business UpdateLYON, France, February 24, 2026 -- Adocia, a clinical-stage biopharmaceutical company, has announced its financial results for the fourth quarter ending December 31, 2025, alongside a comprehensive...

February 24, 2026 - 05:08

Finance expert Anthony O'Neal on unlocking freedomOn a recent episode of a popular live news and lifestyle program, renowned finance expert Anthony O`Neal shared his powerful message on achieving true financial and personal liberation. His...

February 23, 2026 - 03:13

The world's largest energy lender has a new head: Here's how it could shape U.S. policyGregory Beard now leads the Office of Energy Dominance Financing, an entity commanding nearly $300 billion in lending capacity. His appointment places a seasoned financier with deep energy sector...

February 22, 2026 - 06:32

I’m 80 with $1 million. How do I prevent my son from being hit with taxes?Navigating estate taxes is a common concern for seniors aiming to preserve their legacy for their heirs. For an individual with a $1 million portfolio, comprised of $650,000 in investments,...