Which Americans Excel at Money Management? A Financial Literacy Audit

April 20, 2025 - 03:02

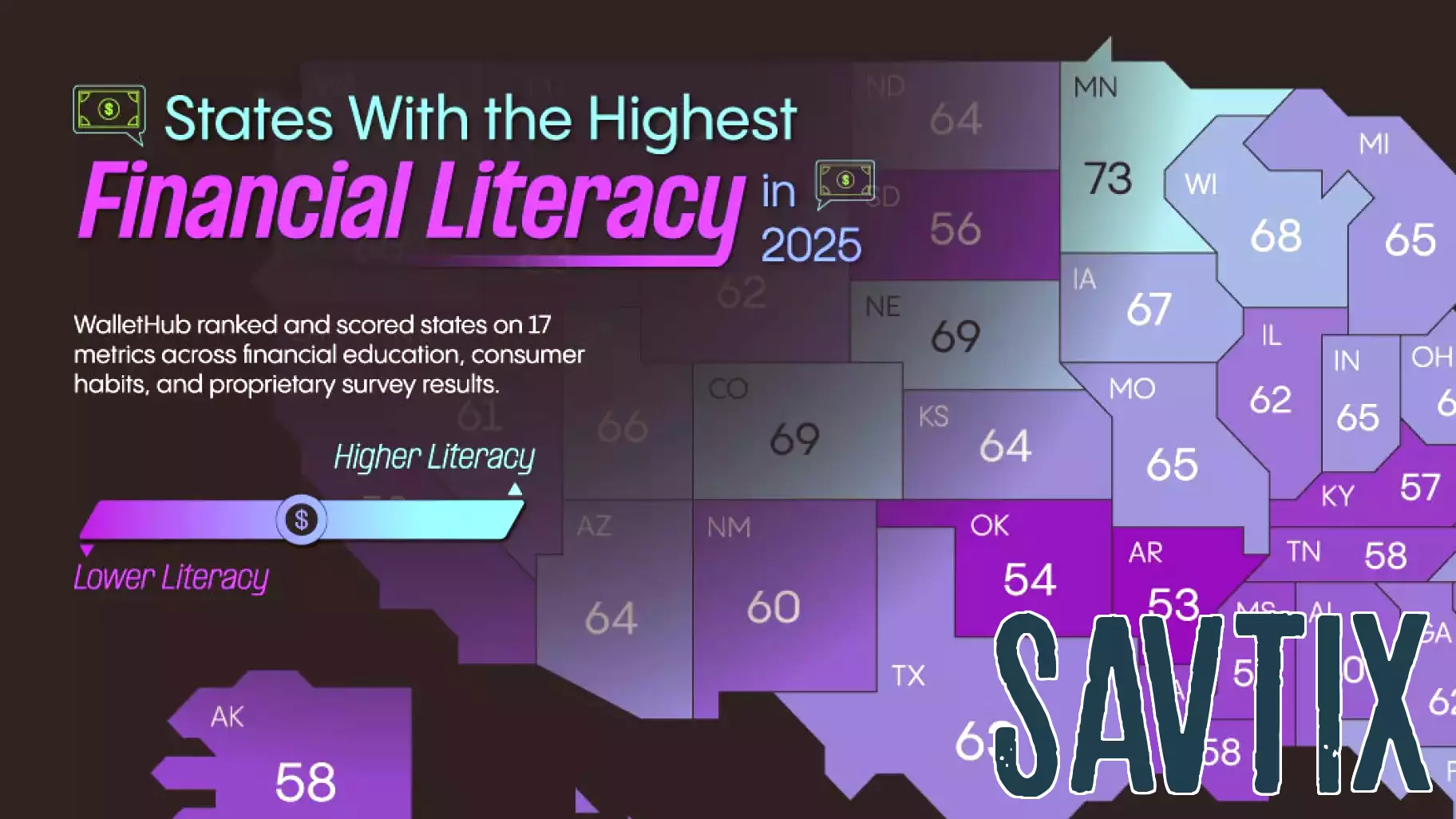

A recent audit has shed light on the financial literacy levels across all 50 states, revealing significant disparities in how well Americans manage their finances. The findings indicate that certain states excel in equipping their residents with essential financial knowledge, while others lag behind.

States such as Utah and Virginia emerged at the top of the rankings, showcasing strong financial education programs and resources that empower individuals to make informed financial decisions. These states have implemented initiatives that promote budgeting, saving, and investing, leading to a more financially savvy population.

Conversely, states like Mississippi and Louisiana ranked lower, highlighting a need for improved financial education and resources. The lack of access to comprehensive financial literacy programs in these areas may contribute to higher levels of debt and poor financial decision-making among residents.

Overall, this audit emphasizes the importance of enhancing financial literacy nationwide, as it plays a crucial role in fostering economic stability and personal financial well-being.

MORE NEWS

February 24, 2026 - 19:13

ADOCIA Reports Fourth Quarter 2025 Financial Results and Provides a Business UpdateLYON, France, February 24, 2026 -- Adocia, a clinical-stage biopharmaceutical company, has announced its financial results for the fourth quarter ending December 31, 2025, alongside a comprehensive...

February 24, 2026 - 05:08

Finance expert Anthony O'Neal on unlocking freedomOn a recent episode of a popular live news and lifestyle program, renowned finance expert Anthony O`Neal shared his powerful message on achieving true financial and personal liberation. His...

February 23, 2026 - 03:13

The world's largest energy lender has a new head: Here's how it could shape U.S. policyGregory Beard now leads the Office of Energy Dominance Financing, an entity commanding nearly $300 billion in lending capacity. His appointment places a seasoned financier with deep energy sector...

February 22, 2026 - 06:32

I’m 80 with $1 million. How do I prevent my son from being hit with taxes?Navigating estate taxes is a common concern for seniors aiming to preserve their legacy for their heirs. For an individual with a $1 million portfolio, comprised of $650,000 in investments,...